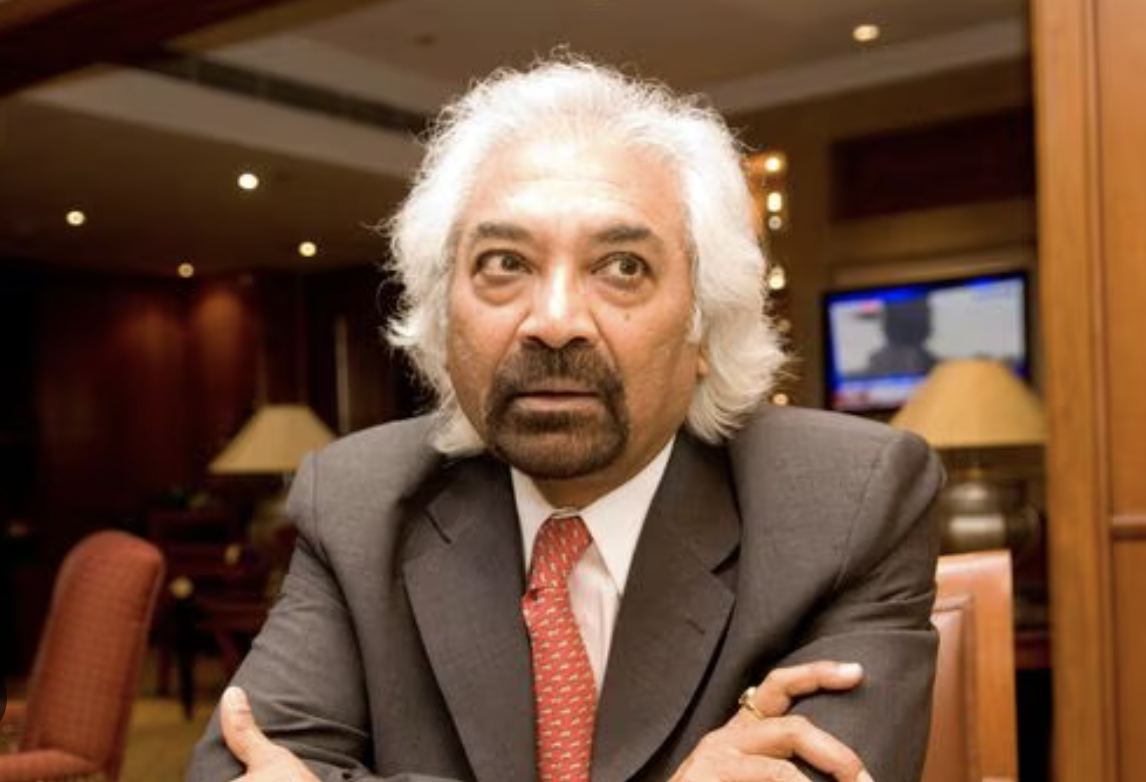

Sam Pitroda, the chairman of the Indian Overseas Congress, has supported the party’s stance on wealth redistribution and pushed for the implementation of an inheritance tax law in the nation.

Mr. Pitroda expounded on the notion of inheritance tax that is already in place in the United States, highlighting the necessity of policies aimed at redistributing wealth. “There is an inheritance tax in the United States. If a person is worth $100 million, the government will likely take over 55% of his estate and only be able to provide approximately 45% to his surviving offspring. What a fascinating law that is. It says that because you are leaving your generation and have amassed fortune, you must leave half of your wealth—not all of it—to the public, which seems fair to me, Mr. Pitroda said.

You don’t have that in India. When a person with a $10 billion net worth passes away, his children inherit $10 billion while the general public receives nothing. People will thus need to discuss and debate these kinds of topics. Redistributing wealth refers to new laws and initiatives that serve the interests of the general public rather than just the very wealthy, the speaker continued.